8 September 2022

Department of the Environment, Climate and Communications

Response to consultation on Electricity Interconnection Policy

MaresConnect Limited welcomes the Department of the Environment, Climate and Communications’ consultation on electricity interconnection policy published on 10 June 2022.

We set out below our key points in response to the consultation and provide a detailed response to each of the consultation questions in the Schedule attached with supporting evidence where appropriate.

Interconnection as a key enabler for energy and climate targets

- Ireland has been clear in its energy ambitions and strategic priorities, setting pioneering targets which are essential if Ireland is to address the current energy crisis, rapidly decarbonise, and leverage the island’s plentiful renewable resources to become a leading exporter of green power.

- Further interconnector capacity (over and above the Greenlink and Celtic interconnectors planned to come onstream by 2030) will be a key enabler to addressing these issues and tackle the ongoing security of supply risk and climate emergency, and most importantly will be an immediate solution in avoiding heavy curtailment of wind power coming onto the system over the coming decade.

Protecting security of supply

- Further interconnection should be prioritised as a central part of Ireland’s overall energy solution in the short and medium term, ensuring security of supply, particularly towards the back end of the decade when Ireland will rely on variable renewable energy to meet 80% of its growing demand and will substitute legacy fossil fuel generation to meet Ireland’s base load demand. As demand continues to grow, because of the rapid drive towards electrification and the ever-increasing number of large demand customers such as data centres, security of supply will continue to be the top priority, particularly for an islanded system such as Ireland. As a result, greater levels of interconnection will play a crucial role in maintaining a safe and secure supply.

- Future changes in the energy mix, such as increasing renewable generation capacity (in particular wind power) will drive the need for additional reserve and frequency response to cater for the variability and intermittency of generation sources. It is therefore important for the System Operators to have access to additional tools and services provided by HVDC interconnectors to manage system frequency to minimise operating costs.

Reducing substantial curtailment

- To meet its energy and climate targets, Ireland will require further interconnection to come onstream as quickly as possible, particularly in the context of the 2030 targets. Further interconnection must be prioritised as a vital part of Ireland’s overall energy solution; providing a route to market for offshore wind and solar, reducing curtailment costs associated with intermittent renewable energy sources, and allowing Ireland to become a net exporter of wind energy.

- DECC’s latest target of an additional 7GW of offshore wind by 2030, on top of the planned 8GW of onshore wind by 2030, will result in substantial curtailment when there are medium to high levels of wind penetration.

- TYNDP 2022 results for Irish interconnector projects demonstrate strong social economic welfare and decarbonization potential. Analysis carried out by our advisors indicates that interconnection plays a material role in reducing the curtailment of RES generation on those sunny, windy days. For example, in 2030 additional interconnector capacity of 750MW would half Ireland’s curtailment from 2TWh to 1TWh. The reduction in RES curtailment is both a direct benefit to producers and specifically renewable generators as well as a benefit to consumers who gain from increased access to low-priced renewable generation.

Policy designed to attract private capital and protect consumers

- Cap & Floor regulation is a viable route for development of future interconnection between Ireland and neighbouring countries. The regime is well defined, has been shown to be financeable by the equity and debt capital markets, and provides an appropriate balance between incentivising developer investment and protecting consumers. Cap & Floor has attracted private capital into the electricity transmission sector to invest in interconnector projects, often in excess of €500m, thereby freeing up state funds to invest in other parts of the economy.

- Prioritisation of interconnector projects will require the investment of resource within the CRU and EirGrid, but when developed by private capital at zero upfront cost to the consumer and (subject to the appropriate scrutiny by the CRU) with a regulatory regime that protects consumers and bring significant social welfare benefits, there is an overwhelming case for prioritising these projects.

Address transition from PCI to PMI to avoid delay in securing new capacity for 2030

- Since the United Kingdom exited the EU, interconnector projects between Ireland and Great Britain are no longer eligible for Project of Common Interest (PCI) status. PCI projects benefit from some minimum requirements for Member States to progress the projects as rapidly as legally possible and, importantly, are eligible for funding under the EU Connecting Europe Facility (CEF). Since May 2022, these projects can apply for Project of Mutual Interest (PMI) status which will apply substantially the same minimum requirements to these projects. PMI status will be granted in the sixth PCI list expected to be published by end 2023. MaresConnect strongly recommends that Ireland does not wait for PMI status to be granted to prioritise these projects. Moreover, this status sets minimum levels of support, and for Ireland to meet its goals it will need to put in place national policy over and above these minimum levels.

Allocation of resources to EirGrid and CRU to maintain momentum of existing projects

- DECC can make a clear policy statement that further interconnection is required as a matter of urgency, and that the relevant government, regulatory and other administrative bodies should treat applications from interconnectors as a priority. This will allow those bodies to allocate the necessary resources and establish work plans to reflect this. In particular, DECC can send a clear signal to CRU that more interconnection is a key priority for addressing Ireland’s energy crisis and should be included in current and future work plans, with dedicated resource to progress projects as they arise.

- The timely development of interconnector projects would benefit from regular monitoring by DECC and the CRU to ensure any obstacles are identified and addressed at an early stage. In the short term, the CRU can address key priorities by putting the resources in place to progress an application from mature interconnector projects and direct EirGrid to progress a connection application as a priority in the similar way that EirGrid has been directed to progress connection applications from any PCI interconnector project. This will ensure that developers are provided clear signals in terms of the administrative roadmap to ensure development projects reach operation by 2030.

Our detailed responses to the Consultation questions elaborate on these key messages and are set out in the schedule to this letter.

Please do not hesitate to get in touch should you wish to discuss any aspect of this response.

Yours sincerely

Simon Ludlam

CEO

Mares Connect Limited

Schedule

MaresConnect’s Response to Consultation Questions

Please see below our response to the questions set out in the Consultation, together with supporting evidence where appropriate.

Ireland’s increased energy ambition

To what extent would a commitment by Government on delivery of further interconnection capacity, beyond the proposed Celtic and Greenlink interconnectors, impact achievement of Ireland’s 2030 and post 2030 energy objectives?

Ireland’s increased energy ambition is consistent with meeting its decarbonisation targets and its aim to leverage the island’s plentiful renewable resources to become a leading exporter of green power. At the same time, Ireland has unique security of supply challenges which are succinctly summarised in the recently published Project Ireland 2040 National Marine Planning Framework:

“Ireland’s all-island electricity system is characterised by its peripheral island location, small size, large generation sets relative to market size, and comparatively limited interconnection, as well as high and rising volumes of intermittent renewables generation. Reflecting these characteristics, and with the objective of bolstering market competition and security of supply, to the benefit of Irish electricity consumers, as well as transitioning to a low carbon energy future, Ireland’s energy policy emphasises the significant role to be played by enhanced electricity interconnection.”

Further interconnection capacity is a valuable tool for addressing both security of supply and facilitate the integration of additional Renewable Energy Source (RES) generation. Taking each of these key points in turn:

Renewable Energy Source integration

- The key changes for the electricity sector are expected to be in the way electricity is generated as mentioned above and how it is consumed. The dynamic operation of the transmission system is dependent on the type of generation connected to it, as well as the nature of demand. Some of the key impacts of these changes to the system are:

- a reduction in system inertia and system strength;

- a greater variability of power flows; and

- the mechanisms to restore the system following a potential blackout.

- The ability to deal with the impact of these changes is dependent on the range of products and services available to the Transmission System Operator and HVDC interconnectors provide sophisticated, robust tools such as frequency response and reserve; black start; and reactive power reserve for managing these changes to ensure economic, efficient and coordinated system operation.

- Future changes in the energy mix, such as increasing renewable generation capacity (in particular wind power) will drive the need for additional reserve and frequency response to cater for the variability and intermittency of generation sources. It is therefore important for the System Operators to have access to additional tools and services to manage system frequency to minimise operating costs.

Curtailment reduction

EirGrid’s Tomorrow’s Energy Scenarios (TES) envisage total generation capacity to reach 12.8GW by 2030 [1].

This imbalance reflects the need to manage the intermittent nature of RES. On sunny, windy days Ireland’s generation satisfies local demand leaving a surplus to export or store. Conversely on still, cloudy days demand outstrips generation capacity requiring the import of electricity from Ireland’s neighbours through interconnectors, the release of storage or the despatch of fossil fuel generating units.

Analysis carried out by our advisors indicates that interconnection plays a material role in reducing the curtailment of RES generation on those sunny, windy days. For example, in 2030 additional interconnector capacity of 750MW [2] would halve Ireland’s curtailment from 2TWh to 1TWh. The reduction in RES curtailment is both a direct benefit to producers and specifically renewable generators as well as a benefit to consumers who gain from increased access to low-priced renewable generation.

Realising Ireland’s export potential

Ireland’s high-volume wind resource, particularly offshore, is now expected to reach 7GW by 2030 with the potential for further material increase as floating wind energy technology is deployed on Ireland’s west coast. Further interconnection will provide a direct route to GB and onwards to demand centres in northern Europe. Access to liquid power markets outside of Ireland will optimise returns for domestic RES developers, maximise Government tax receipts as well as providing Irish consumers access to an abundant source of low marginal cost electricity.

In the context of Ireland’s increased climate and energy ambition, should Government establish future minimum interconnection targets, with capacity to be delivered by a specific point in time? If so, what should these targets be?

Interconnection targets set by the EU under the regulations for trans-European energy infrastructure [3] [4] and the report of the Commission Expert Group on electricity interconnection targets5 are important reference points in determining the future minimum interconnection targets for Member States. The EU has two meaningful targets which set a balance to meeting security of supply objectives without leading to the overbuild of capacity. The first is mandatory and the second a recommendation:

15% of Installed Generation Capacity (15% Generation Target): The European Council of October 2014 requires Member States to meet an electricity interconnection target of 15% of installed generation capacity by 2030 [6] [7]. Although Ireland now operates as a single electricity market (SEM), this test is applicable to the Member State and the calculation would exclude the Moyle interconnector (Northern Ireland to Scotland) and generation located in Northern Ireland.

30% of Renewable Installed Generation (30% RES Target): The EU Expert Group recommends that countries below the threshold of 30% of the ratio of its nominal transmission capacity to its installed renewable generation capacity “should urgently investigate options of further interconnectors”. The recommendation of the expert group reflects the penetration of intermittent renewable power in the energy mix and the need to ensure security of supply on days of low wind and solar production. This test is not mandatory and the expert group recommends including interconnection with third countries to be considered as part of the calculation. It is therefore appropriate to make the calculation on the basis of SEM and all interconnectors including Moyle.

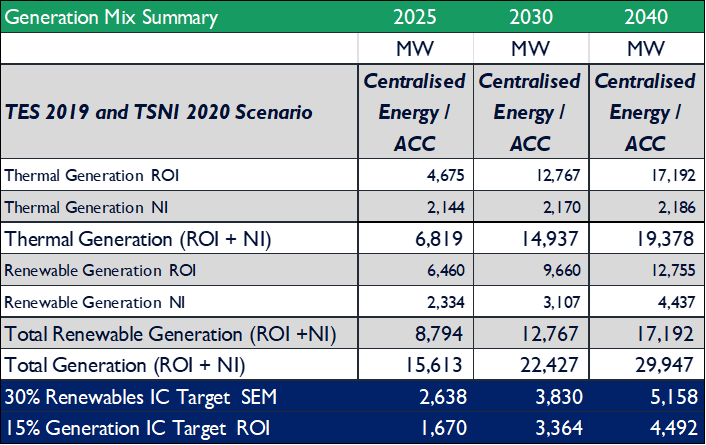

EirGrid’s and Soni’s recent forecasts for Ireland’s mix of thermal and renewable generation (set out in its reports; Tomorrow’s Energy Scenarios, 2019 and Tomorrow’s Energy Scenarios Northern Ireland 2020, summarised in Table 1 below) provide a basis for determining if the tests are met, assuming Ireland will operate four interconnectors (Moyle, EWIC, Greenlink, Celtic and a further 750MW interconnector) by 2030.

Table 1. European Interconnector Capacity Targets

Notes: Greenlink, Celtic and MaresConnect (or other new capacity) are assumed to commence operations before 2030. Moyle is assumed to remain at 250MW over all periods.

Under EirGrid’s central cases of Centralised Energy (ROI) and Addressing Climate Change (NI) and including 750MW of new capacity from 2030 onwards, Ireland fails to meet either test under this scenario or any other TES scenarios.

The forecast growth in RES on the Irish system risks sending uneconomic pricing signals to wind and solar developers, raising the risk that RES project returns will be lower than forecast or worse, fail to materialise. In this context, it is crucial that Ireland progresses new interconnector capacity and takes immediate steps to support mature projects already in development to reduce curtailment costs and avoid RES developers taking projects to other jurisdictions.

Regarding the location of future interconnection, should priority be given to developing further interconnection with Great Britain or the EU IEM, or both?

Ireland’s geographical location limits the neighbours with which it can economically interconnect. To date the focus has been with Great Britain and latterly France. GB is a logical choice given its large generation base, some 10x that of Ireland’s, and its close proximity. Technically this provides interconnection with a diverse generation pool and low loss power transfers. GB is a natural steppingstone to give Irish RES access to the electricity markets in continental Europe and the Nordic countries.

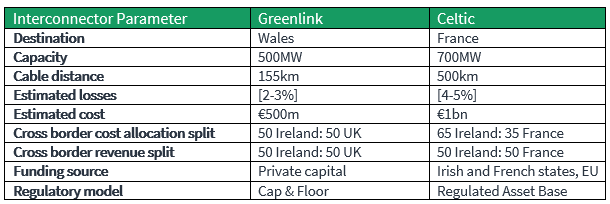

Ireland’s most recent projects; Greenlink and Celtic are both being constructed in a similar timeframe. A high-level comparison of the two projects suggest that careful thought needs to be given to the location of new projects and their economic cost to Irish consumers.

Table 2. Comparison of key interconnector metrics between Greenlink and Celtic

France provides complimentary nuclear base load to Ireland’s intermittent RES and provides integration with another Member State. These advantages need to be set against the cost of Irish consumers shouldering 65% of the project’s high capital costs and power losses over the life of the project.

The recent development of Cap & Floor regulation provides a framework for Ireland and the UK to attract private capital to invest in interconnector capacity thereby freeing up state funds to invest in other parts of the economy. Cap & Floor regulation stimulates the development of new projects by private developers rather than reliance on foreign transmission system operators who may have limited resources to develop numerous projects on different borders in parallel. The regulatory asset base model favoured by France provides a different risk model and transfers greater risk to consumers. Regulated financial returns to the project owners are guaranteed under almost all circumstances.

GB support for further interconnection

Ofgem has recently undertaken a lengthy review of the UK’s need for further interconnector capacity and concluded that now is the time to identify the next group of projects to connect with its neighbours. A third window opened on 1 September and closes on 31 October 2022 for projects to submit applications to be considered for Cap & Floor regulation. The last window was over six years ago and there is no guidance if there will be further windows in the future.

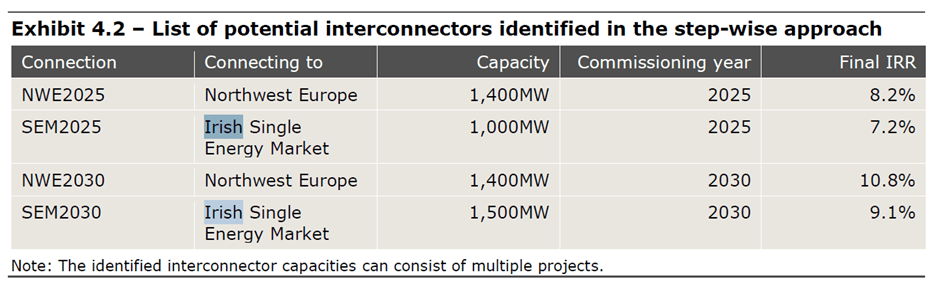

As part of the review, Ofgem commissioned Afry, the economic consultant, to evaluate the need and location of further interconnection on all of GB’s borders. The draft report [8] identified the need for a further 1500MW on the Irish – GB border by 2030 over and above current planned projects to achieve net-zero targets in GB (see Table 3).

Table 31. Extract from Afry December 2020 report

The table above assumes Greenlink is included in the baseline and the additional projects are on the Irish – GB border only.

Ofgem’s clear support of further interconnection with Ireland provides a near-term opportunity to develop further capacity within a favourable environment in the immediate future.

What are the primary benefits associated with increased interconnector capacity? For instance, would the primary benefit relate to enhanced security of electricity supply or de-risking future renewables development?

Increased interconnector capacity provides numerous benefits and to its host countries. For Ireland, additional capacity will provide substantial benefits, as outlined below;

- the risk of security of supply – potential risks to the supply of natural gas and associated gas-fired generation, variability of renewable generation, the ever-increasing electricity demand, and the age profile of the existing interconnectors, means further interconnection will be essential to ensure that a robust generation mix is in place towards the end of the decade.

- reduce curtailment costs – conversely when the wind output is high (anticipated 8GW onshore and 7GW offshore wind) the output will exceed the demand by some margin, so providing additional routes to markets will reduce substantial curtailment costs; and

- stimulate development of further RES – providing greater market capacity will stimulate the whole RES industry in terms of limiting forecast curtailments and constraints, and providing route to other markets.

National legislation

Is the existing legislative framework contained in the 1999 Act appropriate to secure future development of interconnector capacity?

The existing legislative framework in the 1999 Act provides a robust legal basis required for securing future interconnector capacity, evidenced by the recent success of the Greenlink interconnector project reaching financial close. As a near-term project, MaresConnect does not propose any changes to the 1999 Act that would require new or amendments to primary legislation, as there are no legal impediments to making an application for regulatory support under the existing legislation and any amendments would take a long period of time to come into effect.

If any amendments to primary legislation are made (including any amendments to facilitate hybrid interconnection), care should be taken to ensure that such amendments do not inadvertently cause delays to existing projects.

In relation to EU legislation, we note that the introduction of PMI status will be implemented by way of a revision to the EU TEN-E Regulation and will automatically apply to Ireland, without needing to be transposed into national law.

What amendments, if any, do you consider necessary to the 1999 Act?

While MCL doesn’t propose any changes to the 1999 Act, as set out in this response, DECC and the CRU can utilise regulatory policy to promote and prioritise further interconnection to accelerate these projects which are crucial to meeting Ireland’s energy goals.

There are a number of ways that DECC, and in turn CRU, policies could achieve this, including:

Planning and regulatory prioritization for interconnector projects

- Sending a clear policy direction to the CRU and planning authorities that further interconnection is required as a matter of urgency, and that applications from mature projects should be prioritised. This will allow those authorities to allocate the necessary resources to engage with the developers and progress applications as rapidly as legally possible when they are made. This may require adding further resources so that prioritisation of interconnection does not come at the cost of diverting resources from other vital energy goals, such as meeting the target of 7GW of offshore wind coming onstream by 2030.

Ensure greater certainty of regulatory and planning timetables

- DECC engaging regularly with the CRU to monitor the progression of interconnector projects through regulatory processes, including methods of prioritising these projects and target timescales for the relevant steps to obtain regulatory status and obtaining the consents required from the CRU for projects to reach final investment decision and commence construction.

- It is important for developers and NRAs to have clarity as to the expected timeframes for the regulatory processes in each connecting country so that human and financial resources can be efficiently deployed. The development of interconnector projects requires co-ordination between the multiple workstreams such as grid connections, planning and permitting, land acquisition, procurement of construction contracts, financing strategy and regulation. Uncertainties or undue delays in regulation can result in delays or suspension of other activities until greater certainty is obtained. A stop-start approach leads to cost and time inefficiencies which is contrary to the interests of consumers.

Bridge the transition between PCI and PMI status

- Ensure near-term projects which are eligible for PMI status, and which are supported by Ireland in their applications for the same, are not delayed while waiting for that status to be granted at the EU level. For example, CRU could make a direction to EirGrid to progress grid connection applications from projects which are included in the then-current EU Ten Year Network Development Plan. Further detail in relation to PMI status and the requirement for a direction from the CRU to EirGrid to progress connection applications for non-PCI interconnector projects is discussed below.

PMI status

- Great Britain is Ireland’s closest neighbour, with onward interconnection to the EU electricity markets. The introduction of PMI status will be positive for Ireland in recognising Ireland-GB projects at an EU level and making CEF funding available to those projects. However, there is a timing issue that projects which would otherwise have advanced more rapidly with the benefit of PCI (and now PMI) status, could be delayed due to a lack of prioritisation in regulatory and planning processes while waiting for the sixth PCI list to be released by the end of 2023. It would be an opportunity missed if near-term mature projects which are included in TYNDP 2022, with positive TYNDP 2022 CBA results, and which are supported by DECC in their bid to obtain PMI status, are not supported within the Irish regulatory and permitting processes in the period prior to the receipt of PMI status simply because the revision of the TEN-E Regulation has lagged behind the withdrawal of the United Kingdom from the EU.

- For example, the CRU has directed EirGrid to process applications it receives for electricity interconnectors with PCI status [9]. The connection process can take approximately 9 months from the date EirGrid commences processing the application. If EirGrid were to wait until the next PCI list is released to process any new interconnector connection applications, this could result in a delay of 18-24 months to projects which are currently under development. To ensure that near term projects such as MaresConnect are not delayed as a result, MCL suggests that the CRU issues a further direction to EirGrid to engage with such projects to progress the key aspects of the connection (such as confirming the connection point, which is an important dependency for a substantial amount of development work). This would allow projects to progress in the period until PMI status is available and mitigate the impact of potential delays to the benefits of further interconnection coming onstream. This approach to progressing projects even in the absence of PCI/PMI status is consistent with the statements from DECC that “the absence of priority EU infrastructure status should not preclude project development” [10] and the European Commission that “it should be stressed that the candidate projects for interconnection for Great Britain and with Northern Ireland remain very relevant for the Irish electricity system and the Commission agrees with Ireland on the continued importance of the projects concerned, independently of their PCI status” [11].

Brexit and future EU-UK interconnection

To what extent will the development of future interconnection between Ireland and Great Britain be impacted by the removal of Great Britain from European Market Coupling?

- Prior to Brexit, Ireland’s Moyle (2001) and EWIC (2012) interconnectors traded successfully for many years under an implicit auction mechanism lowering wholesale prices to Irish consumers. The introduction of day-ahead, intraday and balancing markets (market coupling) in 2018 resulted in price driven trade flows, rather than the historic pattern of interconnector trade which was not reflective of price signals under the old SEM model. The introduction of market coupling and the development of contacts for difference on neighbouring power exchanges led to improvements in the use of interconnector capacity by ~5% [12]. Importantly, this also led to improved price signalling to the broader Irish and GB markets and in turn to consumers.

- The UK’s decision to exit the Internal Energy Market and market coupling has resulted in a return to the trading mechanisms used prior to 2018. As expected, this has reduced the efficiency of electricity trading with GB’s neighbours including Ireland but only marginally as seen by the recent cost and benefit analysis carried out by ENTSO-E and GB TSOs. For example, the reduction in efficiency of GB – French links without any coupling mechanism is estimated to be less than 5%.

- The proposed Multi Region Loose Volume Market Coupling (MRLVMC) agreed in the Trade and Cooperation Agreement between the UK and EU (TCA) is intended to be a close approximation to replace full market coupling [13] and will reduce inefficiencies further. The GB power industry and regulator are working closely with their European counterparts to meet the TCA deadlines to ensure the implementation of MRLVMC in the coming months. Despite the recent inefficiencies of power market trading following Brexit, there is confidence that an efficient trading system will be in place by the time Greenlink and subsequent GB-Irish interconnectors commence operations.

To what extent will clarity over the future energy relationship between the EU and UK be necessary in order to provide for future interconnection between Ireland and Great Britain?

- In addition to the comments on MRLVMC made above, further consideration should be given to a new administrative pathway to develop interconnectors between EU member states and the UK. Most of the recent EU interconnector projects, including those with a GB leg, have been successfully developed as PCIs [14]. This status is now no longer available to projects connecting to Third Countries and these projects can no longer benefit from access to CEF funding and accelerated planning procedures. This may lead to a slowing of projects with Third Countries which will disproportionately impact Member States on the periphery of Europe, including Ireland.

- The EU has partially addressed this concern in Regulation (EU) 2022/869 [15] updating guidelines for trans-European energy infrastructure. The EU recognises that “The Union should facilitate infrastructure projects linking the Union’s networks with third-country networks that are mutually beneficial and necessary for the energy transition and the achievement of the climate targets, and which also meet the specific criteria of the relevant infrastructure categories pursuant to this Regulation, in particular with neighbouring countries and with countries with which the Union has established specific energy cooperation.”

- As part of the Regulation, the EU establishes PMIs that can demonstrate significant net socioeconomic benefits at EU level and at least one Third Country. PMIs will have similar rights to PCIs, however the EU does not intend to develop a list of PMIs until the end of 2023, as discussed above. This delay puts at risk existing projects just at a time when stimulus is required to accelerate the EU’s response to climate change.

- The Irish government could consider local incentives and planning measures with its UK counterpart to maintain the momentum of existing interconnector projects and bridge the gap between PCI and PMI.

The role of the CRU

Are the technical criteria employed by the CRU in assessing interconnector development applications appropriate?

- The CRU’s assessment criteria set out in the Policy for Interconnectors: Assessment Criteria for Electricity Interconnector Applications [16] are appropriate and fit for purpose. The criteria were used for the assessment of the Greenlink and Celtic interconnectors and MCL is supportive of the same criteria being used for future projects. MCL is supportive of the CRU’s approach to consider projects on a case-by-case basis, which is important for taking an agile approach to assessing projects as they arise. This is particularly important in a market where the demand for further interconnector capacity far exceeds the capacity of interconnectors under development (see Chart 1 above).

- While the criteria are appropriate, earlier engagement and assessment by the CRU could facilitate a more rapid development stage for interconnector projects, particularly those being developed by private investors. The CRU’s current policy aligns the section 2A 1999 Act maturity threshold with the threshold for a cross border cost allocation assessment (CBCA) under the TEN-E Regulation, which includes that permitting procedures should have started in each of the connecting countries. A public interest determination by the CRU at an earlier stage would provide private investors confidence that a regulatory pathway is available when making investment decisions and committing to large development costs (typically in excess of €30m for interconnector projects). This would encourage greater investment at an earlier stage, and ultimately more rapid development timescales. De-risking the project at an earlier stage is even more important for Ireland-GB projects in the period prior to PMI status being implemented as those projects are not currently able to access CEF funding that would otherwise be available to fund 50% of eligible development costs.

- As the CRU undertakes a more detailed assessment at a later stage of development, as was the case for the Greenlink and Celtic interconnector projects, the CRU retains the ability to ensure that the final project is not materially different to the parameters assessed when the public interest test was undertaken. This is commensurate with the process in GB where an initial project assessment focuses on ensuring that the project is credible, being developed by a team and shareholder(s) with the requisite expertise, and with a credible project plan, budget and funding structure. A cost benefit analysis is undertaken at this stage based on a high-level cost assessment, which sets a benchmark for a detailed cost assessment at a later stage when costs are firm following a procurement process for the major construction contracts.

- The CRU took a similar two-stage approach to assessing the Greenlink project; (i) an initial assessment that the project was in the public interest for the purposes of section 2A of the 1999 Act, and (ii) a final decision at which point the project was granted Cap & Floor regulation on the basis of a detailed review of the project and its costs prior to financial close. The CRU could consider updating its policy to make the first assessment at an earlier stage (and in a similar timeframe as the connecting country review) to provide developers the regulatory certainty to proceed with development on the basis that a regulatory regime is available in both connecting countries subject to a final project assessment when the project is closer to final investment decision or financial close.

- This is also necessary for supporting regulatory processes in the connecting country. For example, in GB Ofgem requires evidence of sufficient maturity in the discussions between the project and the regulator and government in the connecting country to show that “the developer’s views on regulatory steps and milestones are aligned with the views of the relevant NRA and government in the connecting country, and that there is broad agreement between the developer and the connecting NRA and government on the key regulatory hurdles, project interdependencies, and timescales” [17]. Failure to engage with projects at an early stage creates a risk that those projects do not obtain initial project assessment (IPA) status with Ofgem. As Ofgem operates on the basis of opening set windows for receiving applications for Cap & Floor regulation, the third of which will be open from 1 September 2022 – 31 October 2022 (the previous window was in 2016, some 6 years ago), failure to obtain IPA status could result in developers delaying or even abandoning the project due to a lack of access to a regulatory route. On the other hand, early engagement with projects to meet the requirements in the connecting country maintains the option for the CRU to progress the project at the appropriate time.

- To facilitate the earlier engagement and assessment of projects, the CRU workplan could be updated to include, and indeed prioritise, the assessment of further interconnector projects. This would have the additional benefit of sending a price-signal to the offshore wind market and encourage deployment of development capital in offshore renewable energy projects as discussed above.

What of the above three regulatory models offers the most viable route for development of future interconnection between Ireland and neighbouring countries?

- MCL supports Cap & Floor regulation as the most viable route for development of future interconnection between Ireland and neighbouring countries. The regime is well defined, has been shown to be financeable by the equity and debt capital markets, and provides an appropriate balance between incentivising developer investment and protecting consumers.

- Throughout 2019 and 2020, the CRU undertook a thorough process to assess the request by the Greenlink interconnector to introduce the Cap & Floor regime in Ireland and apply it to the project, considering the various regulatory models available. We refer to the CRU’s consultation paper on the regulatory regime to apply to the Greenlink interconnector [18] and its decision paper on the Cap & Floor regulatory treatment for Greenlink [19]. As the CRU noted in its consultation paper, the aim of the Cap & Floor regime is “to support efficient investment in electricity interconnectors by underpinning financeability, while retaining performance incentives and limiting consumer risk exposure” [20]. MCL agrees with the CRU’s conclusion that Cap & Floor offers “a suitable balance between providing incentives for interconnector operators to minimise cost and optimise performance providing protection from consumers for excess costs and excess returns; and a protection for debt-holders to ensure project financeability”.

- Based on publicly available information, MCL understands that EirGrid does not currently have plans for further interconnectors after Celtic in the 2030 timeframe. Accordingly, near term interconnector projects, particularly those that facilitate Ireland’s ambitions for 7GW of offshore wind by 2030, will necessarily be privately developed and funded. The Cap & Floor regime has been proven to bring forward private investment in electricity interconnection, first in GB and Belgium and now in Ireland through the Greenlink interconnector project. The Cap & Floor regime is well-tested and proven to be capable of supporting project financing (with both Greenlink in Ireland, and now NeuConnect which connects GB to Germany, reaching financial close in 2022). Privately developed interconnectors are financed by private capital, with construction costs funded by a combination of equity and non-recourse project financing; and do not require government or consumer funding to develop and build the interconnector. By contrast, in June 2022 the Irish government approved a package of measures to help mitigate the rising cost of electricity bills and to ensure secure supplies to electricity for households and business across Ireland over the coming years. This included an increased borrowing limit of €3 billion for EirGrid to strengthen the Irish national grid and to deliver the Celtic Interconnector. [21]

- For interconnectors connecting Ireland with GB, Cap & Floor is the default option and has now been implemented for Irish-GB projects. The Cap & Floor regime in Ireland and GB is based on a 50/50 split of costs and revenues between the two jurisdictions, which protects Irish consumers from bearing a disproportionate level of risk compared to the consumers in the connecting country. A cross border cost allocation which allocates benefits between the two connecting countries and allows for asymmetric regulation is less attractive for Ireland but may be required by the governments and regulators in other connecting countries, such as for the Celtic interconnector which is based on a 65/35 Ireland/France cost split [22] but a 50/50 split of revenues.

General clarification on cross border cost allocation

- MCL would like to make a general point of clarification in relation to the statement in the Consultation that “There is also no legal basis for cost recovery via cross border allocations for projects absent PCI status” (page 10). MCL understands this to be a reference to the ability for PCI projects to make an application under Articles 12 and 13 of the TEN-E regulation for a determination on cross border allocation, which is an alternative to applying under national legislation. The Greenlink interconnector project, for example, obtained Cap & Floor regulation and its authorisation to construct (under section 16 of the 1999 Act) and licence to operate (under section 14 of the 1999 Act) without making an application under Articles 12 and 13 of the TEN-E Regulation. To avoid any misreading of this statement, MCL suggests that DECC clarifies this statement to confirm that there is no legal impediment for non-PCI projects making an application under the 1999 Act.

Hybrid interconnection

To what extent can dual purpose hybrid interconnectors contribute to Ireland’s post 2030 climate and energy objectives?

- MCL is supportive of DECC’s proactive approach in assessing the benefits of, and considering how best to support, dual purpose hybrid interconnector projects which may play a key role in achieving Ireland’s post 2030 climate and energy ambitions.

What is the appropriate policy and regulatory framework to provide for development and operation of dual-purpose hybrid interconnectors?

- The development of multi purpose interconnectors (MPI) has been discussed and consulted on at some length by Ofgem over the last 10 years. To date this has not led to a clear policy or regulation on the treatment of MPI revenues and costs due to the complexity of assessing an appropriate regulatory model. Ofgem’s third window anticipates a TSO sponsored MPI with a member state will come forward as a pilot project for evaluation which may lead to a successful regulatory model going forward. The broader market will review and comment as the project develops and this may provide a suitable proxy for Ireland, however many market commentators consider it is premature to define a policy framework today until the pilot project has been more fully assessed.

The development of regulatory frameworks for MPIs are expected to take time to establish and require significant allocation of NRA resources to develop a model fit for purpose. Given Ireland’s immediate energy challenges, CRU resources may be better channelled into developing additional point-to-point interconnector capacity to meet 2030 targets while maintaining a watching brief on the development of MPIs in the North Sea for implementation in the post 2030 period.

______________________________________________________

[1] The Irish government’s target for offshore capacity by 2030 has recently been increased from 5GW to 7GW

[2] Greenlink and Celtic are assumed to be operational by 2030. A further 750MW relates to additional capacity over and above that provided by Greenlink and Celtic.

[3] Regulation (EU) No 347/2013

[4] Regulation (EU) 2018/1999 addressing the Energy Union and Climate Action with regard to the Treaty of the Functioning of the EU

[5] Towards a sustainable and integrated Europe Report of the Commission Expert Group on electricity interconnection targets, November 2017

[6] Defined as import capacity over installed generation capacity in a Member State “for projects with significant cross-border impact, the impact on grid transfer capability at borders between relevant Member States, between relevant Member States and third countries “– Annex IV of Regulation (EU) No 347/2013

[7] European Council (23 and 24 October 2014) ‒ Conclusions

[8] Ofgem interconnector policy review – independent report, An AFRY report for Ofgem, December 2020

[9] CRU Information Note CRU/17/300 published 24 October 2017

[10] Footnote 19, Section 11.3.4 of the DECC Climate Action Plan published by DECC in 2021

[11] European Commission Staff Working Document published on 19 November 2021 which can be found at https://energy.ec.europa.eu/system/files/2021-11/fifth_pci_list_19_november_2021_swd.pdf

[12] The Value of international electricity trading G. Castagneto Gissey, B. Guo, D. Newbery, G. Lipman, L. Montoya, P. Dodds, M. Grubb, P. Ekins, May 2019

[13] Consultation on the proposed approach to costs for the multi-region loose volume coupling trading arrangements under the EU-UK Trade and Cooperation Agreement, Ofgem May 2021

[14] Regulation (EU) No 347/2013

[15] https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32022R0869

[16] CRU/18/221 published 27 September 2018

[17] ‘Application Guidance for the Third Cap and Floor Window for Electricity Interconnectors’ published by Ofgem 7 July 2022. Refer to Appendix 1, paragraph 1.1.4. Guidance can be found at https://www.ofgem.gov.uk/sites/default/files/2022-07/ApplicationGuidance_ThirdWindow.pdf

[18] CRU20042 published on 26 March 2020

[19] CRU20171 published on 18 December 2020

[20] CRU20042 published on 26 March 2020

[22] CRU decision on Celtic Electricity Interconnector EirGrid Regulatory Framework Request (CRU202213) published 11 February 2022