• Nameplate capacity set to increase by 18.2GW over the coming decade

• De-rated capacity is expected to begin declining in 2023

• Gap to be plugged by expansion of interconnector capacity

LONDON (ICIS)–Ambitious renewable capacity targets underpin the UK’s goal to net zero carbon emissions, which is expected to drive the growth of renewable capacity in the coming years.

ICIS analysis of net capacity changes through to 2030 suggests that the UK will require significant investment in flexible capacity to plug the gap left by the retiring thermal fleet.

Analysis of the anticipated levels of firm, de-rated capacity through to 2030 suggests that growing interconnector capacity will be used to plug the gap, although questions remain surrounding the rate of investment in other flexible capacity.

CAPACITY CHANGES

According to ICIS analytics, nameplate capacity in Britain is set to increase by 18.2GW over the coming decade.

The increase will be dominated by offshore wind (+23.9GW), with support from solar (+3.3GW), onshore wind (+3.5GW) and biomass (+0.5GW).

The government has outlined its coal phase-out plans, which along with recent capacity market results suggests that the UK will only have 884MW of de-rated coal capacity by 2024 and none thereafter, taking coal to a net change of -4.8GW by 2030.

The nuclear phase-out schedule suggests that 7.7GW of nuclear capacity is expected to come offline by 2030, and with only one new plant being added a net capacity change of -4.5GW.

The future of gas capacity remains less certain, with up to 20GW of existing capacity set to exceed a 30-year lifetime by 2030. Overall, ICIS analytics anticipates a net reduction of 3.8GW in gas capacity over the coming decade.

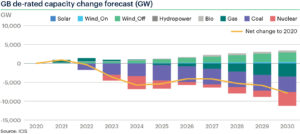

DE-RATING CHANGES

While nameplate capacity is set to expand, the picture looks significantly different once de-ratings are considered.

De-ratings reflect the probability of power flowing to Great Britain during a stress event and are therefore a good metric for assessing security of supply.

The dispatchable nature of nuclear and thermal plants mean that they have far higher de-ratings (80-90%) compared to non-dispatchable solar and wind (3-10%).

Due to coal, gas and nuclear closures, de-rated capacity is expected to begin declining in 2023 and continue to fall through to 2030.

The de-rated capacity fall is set to accelerate in 2024, falling 5.8GW due to the retirement of coal and nuclear plants.

The start-up of Hinckley Point C in 2026 leads to a brief increase in de-rated capacity, before gas and further nuclear plant closures increase the deficit to 7.8GW in 2030.

This suggests that Britain has a significant need for flexible generation or balancing capacity, which may be found in interconnector capacity.

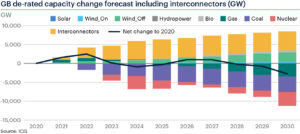

INTERCONNECTORS TO PLUG THE GAP

The British capacity deficit is expected to be plugged by a significant expansion of interconnectors, with the current 5GW of capacity increased to 15.9GW within the next five years.

Interconnectors have consistently been able to outbid much domestic capacity in recent auctions, due to favourable taxing rules.

When accounting for the new interconnector capacity, net de-rated deficit by 2030 falls to 2.7GW from 7.8GW, showing the importance of interconnection in ensuring security of supply.

The additional interconnector capacity will benefit offshore wind in particular by enabling exports during hours of high wind, though Britain will be a net importer at the annual level.

However, questions remain over the reliability of interconnectors during a system stress event

Since system stress events occur infrequently, there is limited historical data on which to forecast future stress events and the likely direction of interconnector flows. This suggests that questions remain over the reliability of interconnector flows in all conceivable system stress events.

Since Britain has a capacity market, this should ensure that adequate supply margins are maintained, though a reliance on interconnectors is inherently riskier for security of supply than domestic capacity.

Original article: https://www.icis.com/explore/resources/news/2020/06/12/10518716/de-rating-data-shows-british-reliance-on-power-interconnectors